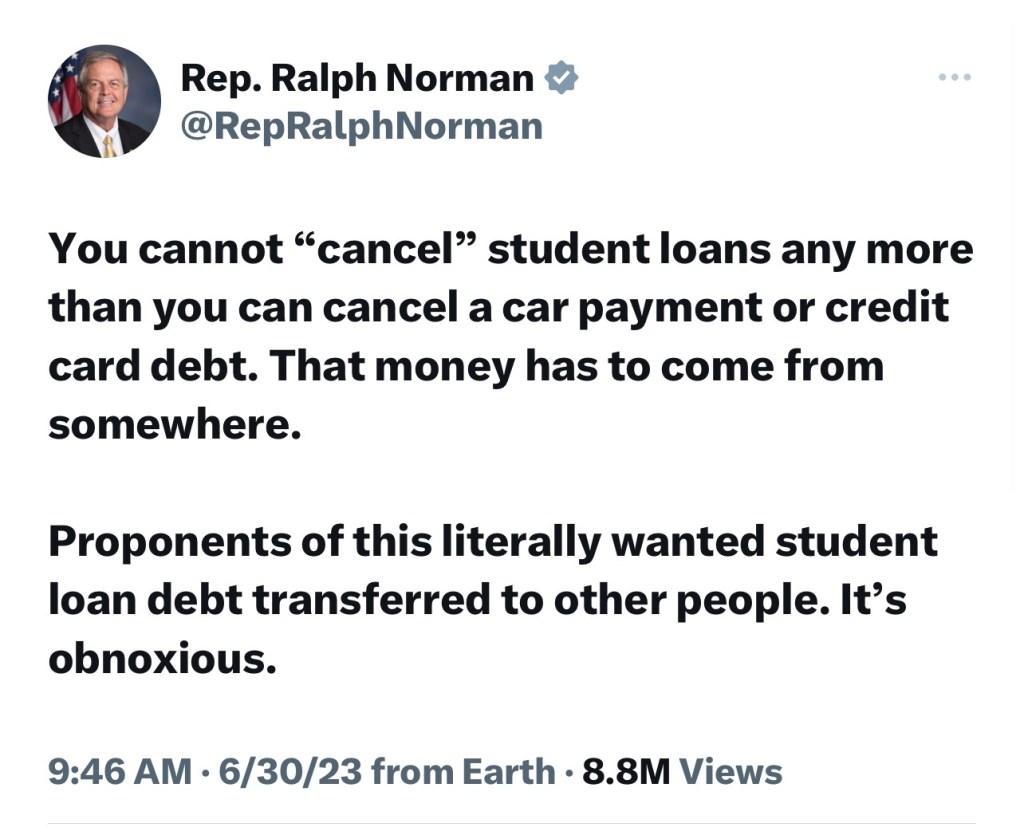

Okay, this guy has inspired my wrath. Who is he? US congressional representative from South Carolina, Ralph Norman. He has a net worth of $40 million. Despite his wealth, he receives a generous taxpayer funded salary he of $175,000. Members of congress all enjoy lifetime health insurance benefits, the added benefit of a guaranteed pension after serving only five years. Mr. Norman received a handout from the Trump administration’s PPP “loan” program. At the request of the millionaire, the government waved his taxpayers footed the bill of $306,520, PPP debt.

PPP is the “pandemic patrol protection.” It was, in theory, a way to keep people on payroll during the pandemic. It ended up in the pockets of several members of congress, friends and family, and multi-millionaire athlete Tom Brady, (tax-exempt) televangelist, Joel Osteen. Here is the shady part. It is called a “forgivable loan” which makes it a grant that they do not expect you to repay.

They call this Capitalism: Trump forgave wealthy Americans and even members of Congress a staggering $760 billion in PPP loans.

President Biden’s plan, allocating $400 billion towards a student debt relief, was deemed unconstitutional. That loan forgiveness was scorned as socialism.

That “capitalism” is hoarded and under-taxed where as “socialism” would provide a boost to the economy,.

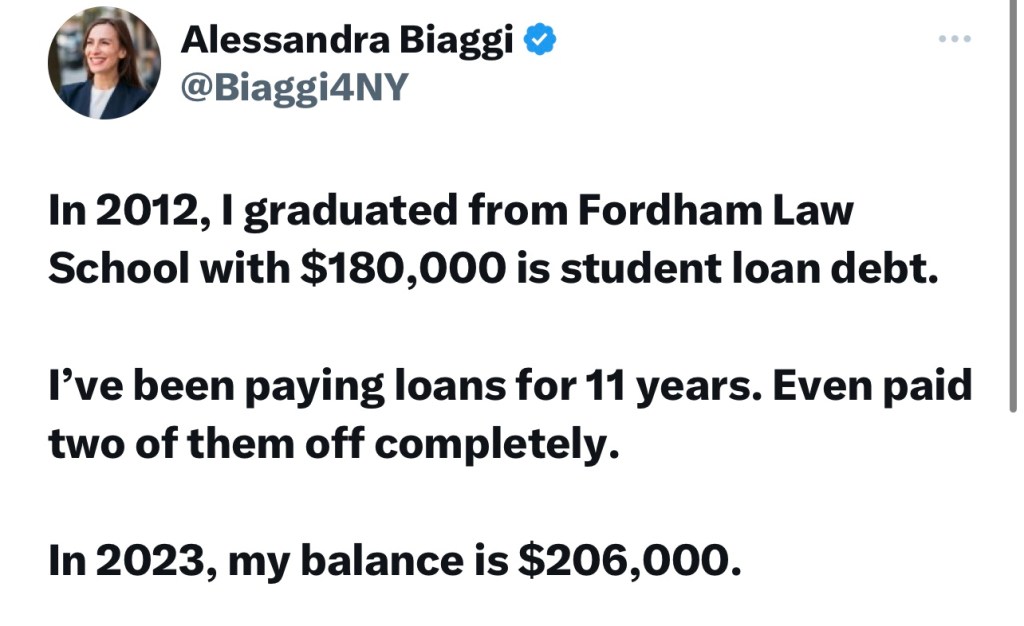

It’s important to note that the landscape of financing a college education has changed over time, and what they developed into now is the same predatory home mortgage of 15 years ago. By law, banks can only provide a home loan to people who prove they can afford to repay them, unlike their practice in the past. However, predatory lenders have refocused their attention to student loans, given to unemployed teenagers who have no credit history. It is a trap, and banks know there is no way out. Gen-X and Gen-Z carry a ball and chain that will hold them back until they’ve reached middle age.

Examples of the trap Student loans have flooded the internet.

I offer my daughter’s situation is an example: She has a $19,000 loan. The loan shark suggests she repay $400-monthly through 2040. Numbers hurt my head, so okay, she can’t afford that, but it sounds fine, she deserves to get an education. She worked hard… wait, let’s do the math.

- This is 2023. 2040 is 17-years away.

- $400-monthly x 12 months = $4,800-annual

- $4,800-yearly x 17-years = $81,600 to pay off $19,000.

- She is paying back over 4 times what she borrowed.

“I’m not paying.” You will pay. Unlike any other debt, you cannot get out of a student loan by filing bankruptcy.

Going into default, (delinquency) these lenders will:

- Garnish payment from wages, or social security.

- Destroy credit scores- which will affect everything. It will show up on background checks on job applications, apartment rental applications, getting utilities installed, and you will pay a substantially higher interest rate for everything, from buying a phone to financing a car.

- The lender can even request suspension of your professional license.

https://www.propublica.org/article/clarence-thomas-harlan-crow-private-school-tuition-scotus

Rightwing billionaire, Harlan Crow, paid $150,000 in tuition for Clarence Thomas’ nephew to attend boarding school, yet college debt relief for students unrelated to him is not okay.

Clarence Thomas took advantage of affirmative action, then voted to abolish it. Yale University officials confirmed Clarence Thomas was admitted to its law school “under an explicit affirmative action plan with the goal of having blacks and other minority members make up about 10 percent of the entering class.”

Oh, look at who was happy about affirmative action when it applied to him: Clarence Thomas in 1983: ‘God only knows where I would be if not for affirmative action.’

Clarence Thomas in 1983: ‘God only knows where’ I would be if not for affirmative action

Fast forward fourth years: when Clarence Thomas voted to end affirmative action, he wrote a 58-page concurring opinion, that the foundational policies of affirmative action “fly in the face of our colorblind Constitution and our Nation’s equality ideal.”

Rules for me, but not for thee.

Hypothetical: A person graduates with a bachelor’s degree, and gets lucky, starting a job less than six months after they received their diploma via zoom. Their $400 student loan payments commence, and despite a decent salary, enough to rent an apartment with roommates, there is no discretionary income. No money left to save for retirement, as a down payment for a home or to start a family. That capital feeds the perpetually subsidized banking system, whose CEOs gorge on bonuses. It is not going back into the economy.

With issues like student debt, the climate crisis, and daily mass shootings, it’s understandable that young people may question their prospects for the future. It’s not surprising that the birth rate in the U.S. has steadily decreased over the past fifteen years. The decline in population could be behind the anti-abortion and forced birth laws in the country. Republicans have stated birth control will be targeted next.

Population decline is the driving force behind child labor law rollbacks. These laws have been in place for over a century. It is likely that we will see a significant increase in children working in adult jobs this summer. Work in meat coolers, assembly lines, and serving alcohol- what could go wrong? Exploited, underpaid, and overworked babies brought to you by the Federalist Society.

We are witnessing the wealthy white man’s latest grasp of self preservation. They want low income families to put their kids to work young. Those children are not likely to be college bound, they’ll no options but to work physically intensive jobs forever. They are creating a new work force to enrich themselves, widening the wealth gap and eliminating competition.

The conservative campaign to rewrite child labor laws

State Child Labor Rollbacks Pose Enforcement Nightmare for DOL

Revoking affirmative action is not about creating fairness in admission. Those affected are people of color, and women, gone with affirmative action. Legacy admissions, with athletes and relatives of staff and donors, constituted 43% of white students admitted to Harvard in 2019. 70% of Harvard’s legacy applicants are white.Legacy admissions combined with family members of staff and athletes, at Harvard, make up almost half of the student body. SCOTUS Brett Kavanaugh lied about his admission to Yale during his confirmation hearings. He was a legacy student. Other legacy admissions include Donald Trump, his three children, and Jarred.

Study finds 43 percent of Harvard’s white students are legacy, athletes, related to donors or staff

Last week’s three rulings came in the one year anniversary of SCOTUS overruling Roe v Wade. We have lost so much to these justices, four of whom lied about their position on abortion during their confirmation hearings. Kavanaugh lied about everything.

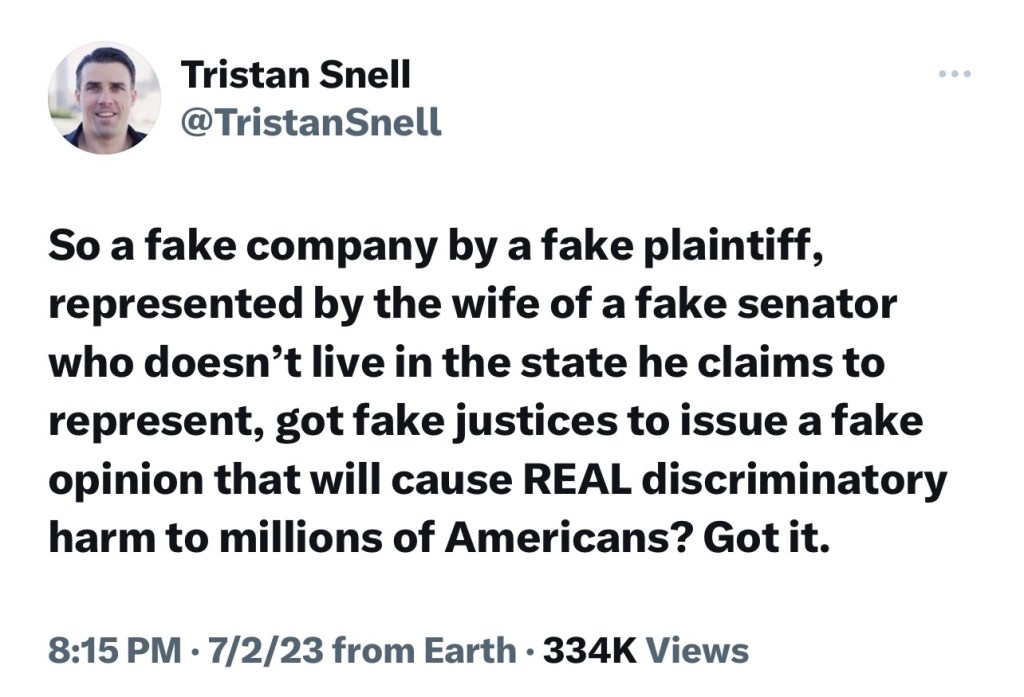

This Supreme Court ruled in favor of a fake business on a fake premise using the name of a man who was not involved. A catholic woman whom has not even started a business sued for the right to discriminate on her (nonexistent) website, to refuse service based on sexuality.

https://apnews.com/article/supreme-court-gay-rights-lgbtq-website-385ec911ce0ca2f415966078eddb66da

The numbers swirling in my head- six, four, three, two…

The six members of the Supreme Court who reversed four rulings, Roe v Wade, student debt relief package, affirmative action, discrimination against LGBTQ, were appointed by three Republican presidents. Two of those presidents lost the popular vote and would have lost the electoral college as well without third party spoilers.

Elections have consequences…VOTE

President Biden needs to address the nature of student loans. Until he does so, even forgiving loans will not solve the problem.

Bankrate.com says: “You can refinance federal student loans, although you must do so with a private lender. This means that you’ll give up federal protections like deferment and forbearance, as well as access to benefits like income-driven repayment plans.” You can only refinance a student loan twice. Interest rates are high, so don’t ask me.

When you sit there and read how the GOP is cheering for these three ‘wins’ from the Supreme Court, and then that woman made up some crazy bogus claim to bring it all the way to the Supreme Court and her attorneys just shrug and say, “Oh, well. We thought it was real…” What in the hell???

LikeLiked by 1 person

The rules don’t seem to apply to conservatives. I think they’ve been planning this for years. It’s unbelievable.

LikeLiked by 1 person